- سبد خرید شما خالی است

- به خرید ادامه دهید

Build Mortgage An extremely Large Credit card

What’s a construction Loan?

What exactly is a houses loan? Manage Now i need it to buy house? Carry out I need that ahead of I commit to strengthening a customized domestic? We’re going to is actually respond to people questions right now.

Very first, a property loan is certainly not the same as a mortgage! That is an important point to discover when you are trying to create a bespoke home within the Denver, Boulder, Texas Springs, otherwise anywhere for instance! Most people fully grasp this proven fact that any large financial company will perform a casing mortgage in fact it is needless to say Completely wrong! You can find most likely a number of home loan pros available to choose from which you will provide framework financing, however, I do believe they have been rare.

All design financing we pick try finance originating during the a financial. The preference within HomeWrights Individualized Home is often having a location lender. We feel local banking companies do the most useful occupations. Whenever i state regional financial. What i’m saying is a lender who’s got roots right there in your community. Whether you are from inside the Boulder, Denver, otherwise Colorado Springs discover an area bank that knows your area. A lot of all of our Owner-Creator website subscribers work with local loan providers.

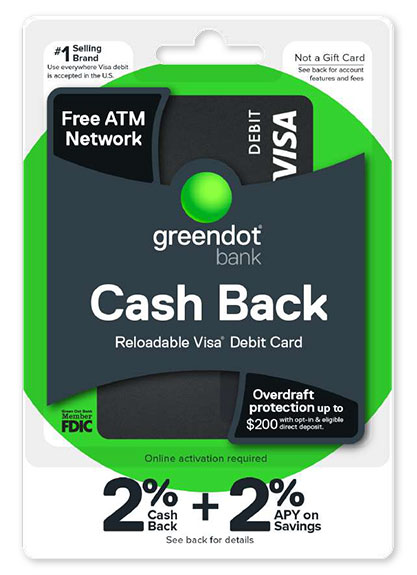

The key to understand is that a houses financing try most a highly high line of credit. In certain indicates, it’s including credit cards. You will have X amount of dollars kepted on precisely how to create your custom home, the credit limit. And often, plus people bucks they have to possess genuine construction, they will certainly also kepted certain cash to essentially pay desire on that financing during the build.

Very there’s an excellent options that structure financing often getting arranged in a manner that you won’t generate out-of-pocket payments throughout the design. The bank could be and come up with people money to you personally. And of course, they’ve been incorporating you to definitely into overall number of the development financing.

You’re not planning has actually duplicate money.

Thus at some point in day, new Piper should be paid, but it’s an approach to get custom home depending in place of having to generate monthly obligations. I think that’s, that’s a really important part for people to understand would be the fact you could stay in your existing house and you can build your brand new house with their build financing. You aren’t attending has actually copy costs.

No. 1 Differences when considering Construction Financing And Mortgages

- Amount of time: Typical family design loans are quick-identity deals you to definitely basically continue for on annually. A home loan has actually differing terms and provide you any where from ten in order to 3 decades to settle. An interest rate is not usually readily available for this new structure in the event some loan providers possess particular hybrid products that provides a combo regarding each other.

- Payment Punishment: Construction money is actually quick-term financial devices and don’t punish your to possess very early cost of one’s balance. Mortgage loans have penalties to have early payment. Penalties, or no, start around lender so you can lender.

- Focus Payments: Structure financing charges interest to the number of the loan used throughout the just in design processes. In the event the whole matter assigned isnt used, the fresh new borrower will not pay the whole interest number. Mortgages charge the fresh https://paydayloanalabama.com/samson/ borrower attention towards complete quantity of the new mortgage.

- Homes Instructions: Structure funds provide new house designers to the upfront financing needed to order house on what to construct. Normal mortgages dont generally speaking ensure it is land requests.

- Build Rates Pay back: Leftover costs out of bespoke home structure will likely be paid down from the obtaining home financing on the complete family. The regards to your home loan start from financial to lender therefore do your research. Mortgage origination fees, interest rates, and you will amount of monthly premiums are very different. Certain terminology try negotiable inside an aggressive business.

I believe this really is a really crucial difference and work out through the construction. Your structure loan would be increasing plus the basic few days you may only are obligated to pay $50,000. From the eighth week otherwise ninth times otherwise 10th day, it is possible to owe 350,000 or 500,000 or 700,000 otherwise $800,000 on your framework mortgage. Whether your custom-built home is carried out with all the structure you could shop for a lending company who will following pay from one to structure loan. The development loan simply disappears. Its paid by your the brand new home loan.

Front side Mention: Should you decide to act as your very own general contractor and you’ve got almost no experience, extremely lenders are likely to timid of providing you an excellent design financing. As to why? They cannot exposure putting aside high money for someone just who you’ll have trouble with permits or is not able to discover subcontractors to find the work carried out in a fast and you can top quality fashion.

This means that, they should learn he or she is funding a housing investment you to is about to get done properly. That is why HomeWrights Owner-Builder subscribers have a much better chance of bringing a property mortgage since the financial understands HomeWrights have a proven track record of at the rear of its subscribers so you’re able to a successful consequences.

Structure Financing Choices

There are instruments available to you, entitled that-go out romantic loans. That type of build finance and in actual fact automatically converts into a beneficial financial. We’re not regarding the financing providers thus you’ll need to store because of it brand of product.

When you’re anyone with a good credit score and you may a decent job records, after that hunting will likely pay back for you because the banking companies require people who have a good credit score and individuals that have an excellent an excellent occupations records. It always make you to definitely design financing and it’s really occasionally possible to help you negotiate into those people structure finance. Maybe you will get the interest rate off or slow down the origination fees off somewhat. All the little bit facilitate when you’re building a bespoke home!

Framework credit is a bit piece of an elaborate layout and our company is always happy to express any sort of information we have about the subject. Feel free to contact us and we will getting delighted to generally share almost any we could. Whenever we cannot reply to your question, we are able to yes reason for the fresh advice of somebody who will!

As to why HomeWrights Custom Home?

All the bespoke home is special and you can HomeWright’s possess a team of elite group designers to partner with your since you create wide range to have the next from the becoming your bespoke home creator.

Regardless if you are taking advantage of the Owner-Builder system or our very own Turnkey approach to strengthening your own custom-built home, accepting the necessity of goal setting techniques and achieving clear motives tend to generate one trip to your fantasy family a lot simpler!